Financial Calculations and the Cash Flow

Financial Mode

The cash flow application is intended to be use to solve problems where cash flow occur over regular intervals but are of various amounts.

Organizing Cash Flows

The cash flow series is organized into an initial cash flow (CF0) and succeeding cash flow groups. CF0 occurs at the beginning of the first period. A cash flow group consists of a cash flow amount and the numbers of times it repeats.

Constructing a Cash Flow Diagram

The time line is a horizontal line divided into equal periods such as days, months, or years. Each cash flow, such as a payment or receipt, is plotted along this line at the beginning or end of the period in which it occurs. Funds that you pay out such as savings deposits or lease payments are negative cash flows that are represented by arrows which extend downward from the time line with their bases at the appropriate positions along the line. Funds that you receive such as proceeds from a mortgage or withdrawals from a saving account are positive cash flows represented by arrows extending upward from the line.

Entering Cash Flows

You can enter cash flow in two different ways.

Calculating Net Present Value

The NPV function is used to discount all cash flows to the front of the time line using an annual interest rate that you are supply.

Example : A discounted contract, uneven cash flows.

You have an opportunity to purchase a contract with the following cash flows :

End of the month |

Amount |

4 |

$ 5000 |

9 |

$ 5000 |

10 |

$ 5000 |

15 |

$ 7500 |

25 |

$10000 |

How much should you pay for the contract if you wish to yield a yearly rate of 4.5 % on your investment?

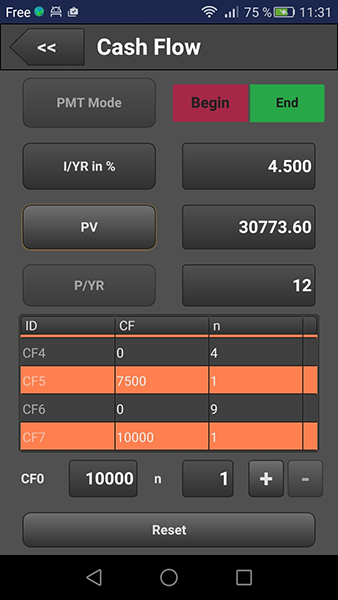

You enter the data this way and click on the 'PV' button.

The result is $ 30773.6. Notice that this amount is positive. The NPV is simply the summed value of a series of cash flows when they are discounted to the front of time line.

Calculating Internal rate of return

When you calculate I/YR, you get the annual nominal rate that gives an PV of zero. The following example uses the cash flows that were entered in the previous example.

Example : If the seller of the contract in the previous example wants $ 31000, what is you yield?

You click the 'IRR/YR' to calculate the answer : 3.89 %.

Copyright © <2016>, <Serge Nicolas>